totally misleading. For rents, the tenants are the ones who pay stamp duty! In the event of an increase in rent or an extension of the term of the lease, stamp duty must be paid on the document based on the increase in rent or the rent of the extended tenancy period. In Singapore, a tenant must pay a tax (surprise!) in addition to the monthly rent and deposit when signing the rental agreement. Otherwise known as stamp duty, it is payable if a tenant: For landlords, it is common to wonder if their tenants have paid their stamp duty in the tenancy agreement. Freight no, there is a way to find out if it is on the IRAS website. All you need is to get the reference number for the document and the stamp certificate. You can sign the agreement with your owner via the IRAS e-stamping portal. Rightly so, the tenants are the ones who pay stamp duty. The party that is required to pay stamp duty is generally indicated in the agreements.

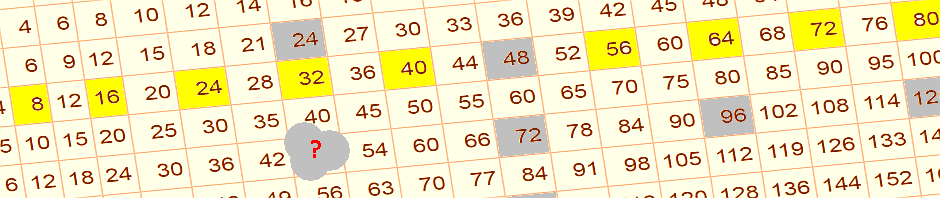

For example, if you are renting a property, the rental agreement should indicate who should pay stamp duty. Source: IRAS. (It also applies that if you are good at negotiations, the landlord can refund or pay the stamp duty amount for you, but the payment should always be made on behalf of the tenant). I simplified the message in this article. Thank you for reporting it and for informing us! Do you have a great day 🙂 If your monthly rental fee is $2,000, here is an example calculation to get the amount of the tax: you must also provide information and other related details from your tenants at the time of registration. An administrative fee of $10 per bedroom must be paid if authorized. You can save rental data online and update the registration data on My HDBPage (connect with your singing passport and go to: My Flat > Bought Flat > Renting Out) via the following e-Services: However, if a reduction in rent or the duration of the rental is shortened, the document`s stamp duty is not payable. Once you have insured that your rental is legal in Singapore, you have 10-14 days from the start of the rental to pay the stamp duty. See more rental-related items here: Latest real estate updates March 2018: Stamp Duty Rule and Subsidized Housing for Divorcees and The Increase in Buyer Stamp Duty Will Not Stop The Dynamics of the Real Estate Market A variable rent lease is a contract for which rent varies during the rental period. Stamp duty on leases must be paid on the basis of contract or market rent, depending on the higher amount, at rent tax rates. A premium rental agreement is a lease agreement for which a lump sum payment is made. Stamp duty must be paid on the premium on the basis of BSD rates.

In the case of a rent supplement to the premium, stamp duty on rent must be paid on the basis of rental tax rates. (i) A fixed rent lease and an additional rent on the basis of a percentage of gross sales (GTO), without a maximum or minimum guaranteed amount Please note the examples 1 to 3 below to calculate stamp duty for leases with a staggered rent or percentage of GTO. Hello Xoo, you are right 😀 Stamp duty also applies to room rentals.