The credit agreement form model below is a generic pdf model for personal credit agreements that you can download and modify to suit your requirements. You can customize the PDF and add your own details using PDF Expert – the best PDF Publisher app for iOS and Mac. Download free PDF Expert to get started with this free PDF loan template. For private loans, it may be even more important to use a loan contract. For the IRS, money exchanged between family members may look like either gifts or credits for tax purposes. A subsidized loan is for students who go to school, and their right to glory is that there is no interest while the student is in school. An unsubsidized loan is not based on financial needs and can be used for both students and higher education graduates. The personal loan form is a legal document signed by two people ready to make a credit transaction. This loan form documents written proof of the terms and conditions between the two individuals, namely.dem lender and borrower. A lender can use a loan contract in court to obtain repayment if the borrower does not comply with the contract. If the total amount of the loan is of great value, it is a good idea to require the signature and details of a guarantor – someone who can vouch for the borrower and work as a guarantee of repayment, the borrower should not be able to repay. For more information, check out our article on the differences between the three most common credit forms and choose what`s right for you. A loan agreement is a legal contract between a lender and a borrower that defines the terms of a loan.

A credit contract model allows lenders and borrowers to agree on the amount of the loan, interest and repayment plan. The state from which your loan originates, the state in which the lender`s business is active or resides, is the state that governs your loan. In this example, our loan came from new York State. If this loan document does not meet your requirements, we offer other types of loan contracts, including: renewal contract (loan) – extends the maturity date of the loan. 3. Loan period: This loan is valid for a period of 3 months, calculated from the date of the agreement using a loan contract, protects you as a lender, as it legally implements the borrower`s commitment to repay the loan in regular payments or lump sums. A borrower can also find a loan agreement useful because he spells the details of the loan for his files and helps keep an overview of the payments. The first step to getting a loan is to make a credit check on itself, which can be acquired for $30 from TransUnion, Equifax or Experian.

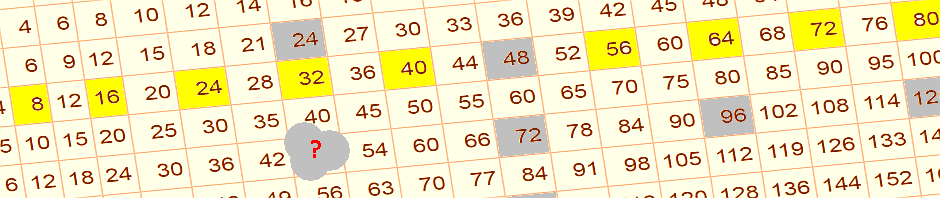

A credit score ranges from 330 to 830, the figure being higher, which represents a lower risk for the lender, in addition to a better interest rate that the borrower can get.